Work can begin on a controversial project for dozens of new flats in Wokingham town centre, none of which will be affordable.

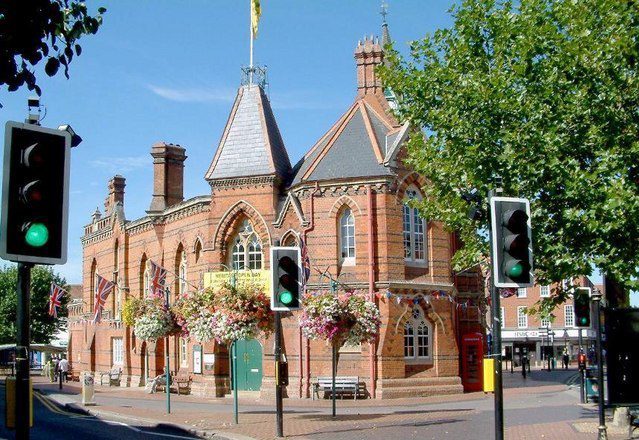

The legal agreement required between the council and developers has been signed for plans which will create a new mixed-use development at Market Place, at the heart of the town centre.

It will see developer Devonshire Metro 60 new homes, commercial floorspace, public and private amenity space, and a new pedestrian route.

This will be done after the demolition of numbers 19 and 20 Market Place, currently home to Robert Dyas and the now-closed Lloyds TSB Bank.

While numbers 19 and 20 Market Place will be demolished, the façade of 21 Market Place, home to Edinburgh Wollen Mill, will be partially retained.

A total of 36 car parking spaces and 115 cycle spaces will be created alongside the new homes.

Architect firm Architecture Initiative says the development would ‘revive’ an ‘under-used’ patch of Wokingham town centre.

The plans were approved in February by Wokingham Borough Council’s planning committee despite concerns that the project would deliver no affordable housing.

Speaking at a planning committee in February, Councillor Rachelle Shepherd-DuBey said: “As someone who grew up in affordable housing, I really think it’s a horrible idea that we don’t have any affordable housing in this development.”

She added that allowing such developments could help make Wokingham ‘a town for only the rich, not for the average earners or the poor.’

At the time, council planning rules say developments of at least 15 homes in a ‘major development location’ such as Wokingham town should include at least 30 per cent affordable housing.

This has since increased to a 40 per cent contribution, as part of the authority’s local plan for housing, recently approved by councillors.

This will become binding once approved by a government inspectorate.

But laws say developers don’t have to do this if they can provide a ‘viability assessment’ showing construction costs mean they wouldn’t make a profit without charging full market rates. This then has to be approved by an independent financial consultant.

A ‘viability assessment’ submitted by developers said they couldn’t profit from the project if any of the flats were reserved for ‘affordable housing.’

The Section 106 legal agreement between the council and developer contains the condition that once the project is delivered, a ‘viability review’ be undertaken to ‘confirm the situation has not changed’.

Following the completion of this agreement, work can now commence on the project.